The Only Guide for Pkf Advisory

Table of ContentsAll About Pkf AdvisoryAn Unbiased View of Pkf Advisory9 Easy Facts About Pkf Advisory ExplainedThe Pkf Advisory IdeasA Biased View of Pkf Advisory5 Easy Facts About Pkf Advisory ShownExcitement About Pkf Advisory

As any type of entrepreneur recognizes, earnings are important to the success of any company - PKF Advisory. Without a consistent flow of income, it would be impossible to pay workers, rent workplace room, or acquisition stock. There are a number of ways to boost profits, and one of them is to outsource monthly solutions.With the aid of a good accounting professional, businesses can increase their profits, conserve money and time, and raise their overall effectiveness. Outsourcing your accounting requirements can lighten your plate, offering you even more time to concentrate on other elements of running your organization. With these solutions, a company can have peace of mind understanding that its finances are being took care of appropriately.

3 Simple Techniques For Pkf Advisory

Furthermore, regular monthly solutions can assist a firm capture small problems before they become big ones. Because of this, making use of these services monthly is a vital method for a company to safeguard its monetary health and wellness. Outsourcing bookkeeping is an effective method to decrease expenses. Dealing with a skilled accounting professional can obtain the monetary aid you require without hiring a permanent worker.

Managing an in-house bookkeeping group can be pricey, specifically for smaller not-for-profit organizations with restricted spending plans.

Rumored Buzz on Pkf Advisory

TABULATION Customer Accounting & Advisory Services (CAAS), describes a variety of economic and bookkeeping services offered by audit firms to their customers. It concentrates on managing and taking care of the financial events of customers. These solutions can differ based upon the certain requirements of the customer however typically consist of accounting, pay-roll handling, economic coverage, and basic financial advisory.

Budgeting is the process of producing a strategy to spend cash over a given duration, based upon predicted revenue and expenses. Forecasting prolongs this by forecasting future economic problems and performance based upon historic information and analysis. Assists in tactical preparation, resource appropriation, and financial goal setting. Forecasting helps expect future economic requirements and challenges, allowing aggressive decision-making.

A Biased View of Pkf Advisory

Helps services save cash through reliable tax obligation preparation and avoid charges associated with non-compliance, thereby protecting revenues and promoting lawful operations. These parts are interrelated and jointly support the monetary monitoring and tactical preparation efforts of a business. By leveraging CAAS, services can guarantee the precision and conformity of their financial operations and get beneficial insights and advice to drive development you can check here and boost profitability.

Get This Report about Pkf Advisory

Outsourcing CAAS can lead this content to even more prompt and exact economic coverage. Outside professionals are dedicated to preserving current and specific economic records, offering companies with the info they need for informed decision-making. Outsourcing partners may provide valuable insights originated from information analytics and economic expertise. This can add to critical monetary planning and help businesses make informed choices that line up with their overall objectives.

This permits for a more focused effort on tasks that directly add to the growth and success of business. Audit and monetary management jobs can be lengthy. Outsourcing permits services to unload these administrative worries, making it possible for interior groups to concentrate on jobs that require their certain skills and interest.

Here are crucial considerations for selecting the appropriate CAAS service provider: Evaluate the supplier's know-how in accounting and monetary monitoring. Search for certifications, market acknowledgment, and client reviews that show their proficiency in supplying CAAS remedies. Analyze the provider's innovation framework and software abilities. Ensure that their system is scalable, safe and secure, and outfitted with features that satisfy your service demands, such as automation, integration with other systems, and personalized coverage functionalities.

6 Easy Facts About Pkf Advisory Shown

Identify whether they offer thorough accountancy services that straighten with your business needs, including accounting, monetary coverage, tax obligation conformity, and consultatory solutions. Meticulously examine the service contract and terms of engagement prior to committing to a CAAS provider. Pay interest to essential stipulations such as solution levels, prices structure, data possession and safety, confidentiality conditions, and disagreement resolution systems.

In 2013, Rick DeLuga and Glenn Smith bought MK Industries from the initial proprietors and KRD has continued to recommend them (PKF Advisory). "KRD is conservative naturally like we are, and because they had been with business so long, they knew that we are and how we run," Glenn claimed

The Of Pkf Advisory

As president of the business, Rick favored an independent controller partnership to look after internal team and to be an expansion of the exec group for regular interaction. The landscape of Client Bookkeeping and Advisory Services (CAAS) is developing rapidly, driven by technological advancements, transforming organization characteristics, and regulative shifts. Here are some future trends in CAAS: The assimilation of anticipating analytics devices into CAAS systems enables accountancy specialists to examine historical data and predict future fads.

This includes helping businesses gauge and report their sustainability efforts accurately. The regulatory landscape is dynamic, and CAAS companies must remain abreast of modifications in accounting standards, tax laws, and compliance needs. This includes proactive tracking and timely adjustment to ensure customers remain certified. CAAS platforms will likely include innovative compliance devices that leverage automation and AI to simplify conformity processes.

Mara Wilson Then & Now!

Mara Wilson Then & Now! Romeo Miller Then & Now!

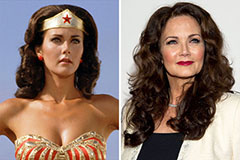

Romeo Miller Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!